EUR/USD trading talks March 23

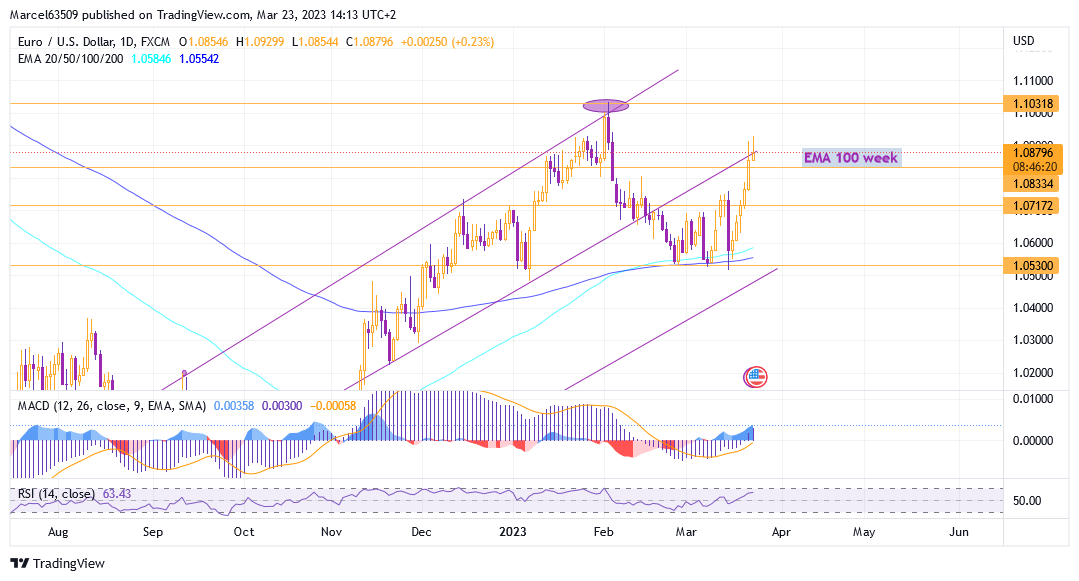

This week the LUX trading will start later as the situation with the EUR/USD has changed and I had to reject the head and shoulders option and rebuild the trading plan. For now, I see that the 1.05300 level, where the EMA100 and EMA 200 lines were placed on the daily chart, has provided strong enough support to withstand the pressure and prevent the downtrend from breaking.

Euro Dollar gained more than 400 points in a week, which gave many traders confidence in the continuation of growth.

I want to draw attention to the fact that EMA 100 crosses 1.08300 on the weekly chart, which leaves the possibility of further growth open and points to the nearest resistance level at 1.10275 and 1.11000 EMA 200 on the weekly chart. Despite the high probability of continued growth, I also want to consider the option of a correction and a decrease to the level of 1.07200, but I must admit that a number of support levels (1.08300, 1.07750 (hourly EMA 100) will prevent a deep correction.

It is also important to note that upon reaching 1.10275, there will be an option for a double top formation and further fall within this pattern.

Based on the current data, I would look very closely at the growth option, but in case of a decline below 1.08300, as a marker level, I will consider trading on a correction.