EUR/USD trading talks September 07

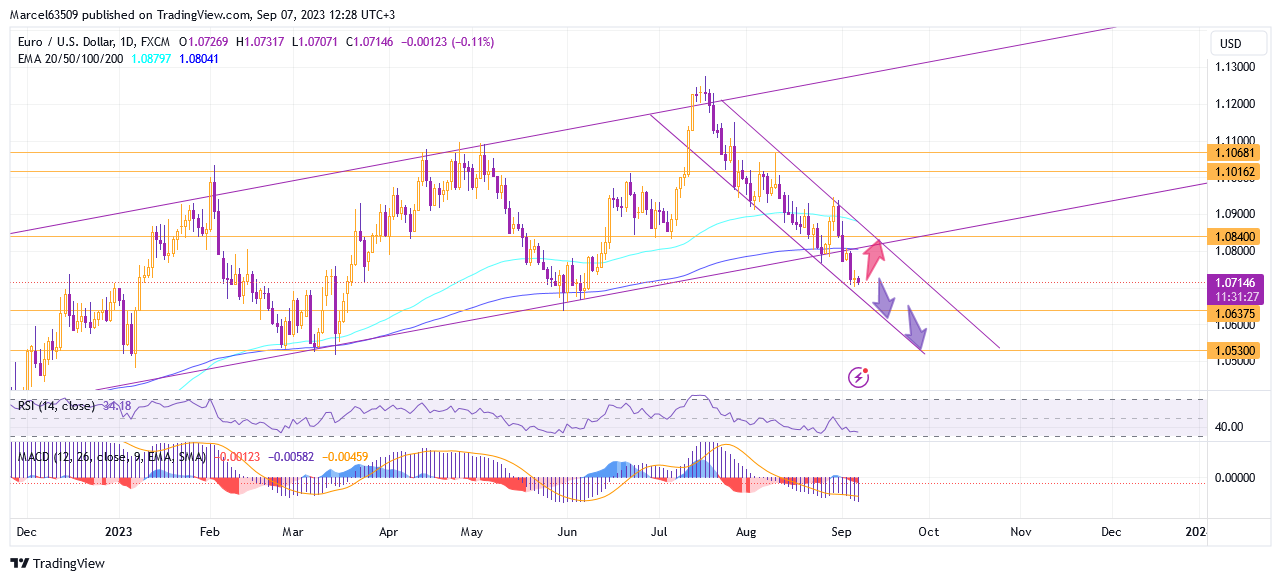

The EUR/USD is reaching the historical key level of 1.06375, which may stop the current decline and become a turning point for a short-term correction. Also, I would like to mention the marker support at 1.07000, which currently has an impact on the market and if the price level falls below it, then a further fall to 1.06375 will be highly likely.

The euro dollar finally broke out of the uptrend, breaking through its support after a short-term rise to 1.09445. The MACD on the daily chart makes it clear that further decline will continue despite the RSI being close to oversold. This and the formed divergence on the hourly chart, may be signals for short-term growth, similar to one that was at the end of August. The estimated level that can be reached during the correction is EMA 200 on the daily chart 1.08000 and also historical 1.08400. However, I consider a return to the trend area to be unlikely and at the moment I expect a continuation of the fall to 1.06375 and further to 1.05300.

In the long term on the weekly chart, the MACD signal and position of the EMA lines, as well as the position of the RSI line, gives reason to believe that we should expect a long term decline.