Correcting mistakes and analysing successful trades is a key trading process.

A very good practice is to write down your mistakes and successes so that you connect the subconscious mind to solve problems and remember successful actions.

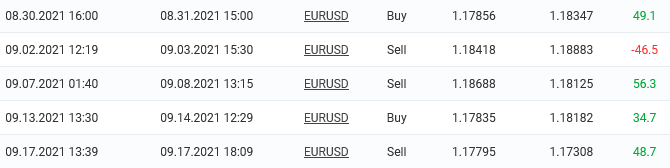

Below I will analyse some of my trades (See the image above). I hope my post will help you to find a way to develop trading process and clear mistakes.

1.

– MACD signal

– EMA 200 breakout

– According to the trend.

The stop loss is set below the resistance level. There is an alternative to exit the market in case of resistance at the 1.18100

2.

I rushed, not receiving a clear confirmation from main indicators, and at the same time did not foresee a possible movement through the 78.6% retracement level.

It was possible to set a stop loss closer, just above the key level 1.18600, that’s breakout opens continued growth. If the uptrend were broken, there would be a risk of the fall completion at the key support 1.17950. The trade might have had to be closed prematurely with a small profit.

3.

– Clear MACD and RSI indicators confirmation

– The key high level 1.19060 was not broken

– Opening time frame is 4 hours.

The stop loss was moved to the profit at 1.18562 in case the key support at 1.18350 completes the decline.

4.

– Quite risky buy trade on the downtrend correction, near its support

– The key fact is 50% correction level was reached taking into account 4 hours.

– Strict stop loss level.

Close on touch EMA 50 but I see that I rushed and missed 24 pips.

5.

– Late but clear signal MACD

– EMA 50 touch

– correction depth is more than 50%

– confident downward.

Opening after a local upward correction and close by take profit before the key level 1.17300 and trend support.

See mytrades on myfxbook: https://www.myfxbook.com/members/MarcellusLux/lux/8591067