Trading profit / loss analysis of EUR/USD trade

Today’s analysis is related to my EUR/USD trade on September 27th. Please also welcome to read about my analysis of profitable trades that I made before at this link. I tried to explain the reasons for my decisions.

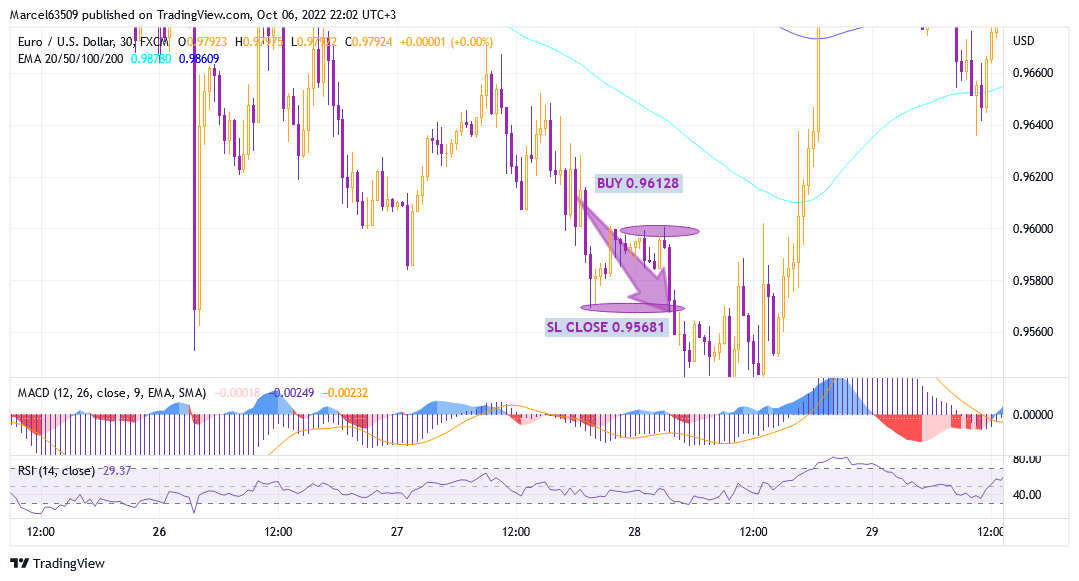

So, the Euro/Dollar, according to my forecast, had a clear divergence on the daily chart. Declining to the levels of 0.95700 formed a narrowing correction, which can be seen on the four-hour chart, where the MACD showed a crossing line signal for a further increase. At the same time, on the hourly chart, the correction showed a strong upward potential and show a convergence on the MACD as confirmation of further growth after going beyond the correction. I waited until the price starts to fluctuate steadily around the key support area of 0.96000 and opened a buy trade.

The first critical moment was when it reached 0.95700, when it became clear that the narrowing correction had changed to a directional corrective trend, and in case of an absolutely correct trading decision, it was necessary to close the trade during the following growth and fluctuations around 0.96000 key level. But instead, I was counting on a rise to the higher 0.96300. However, as the result the trade was close at stop loss level 0.95681.

Thus, this is the mistake in too high deviation in risk management. In this situation, it was necessary to respond to risk signals with higher sensitivity.