The trading profit / loss analysis on my PAMM account

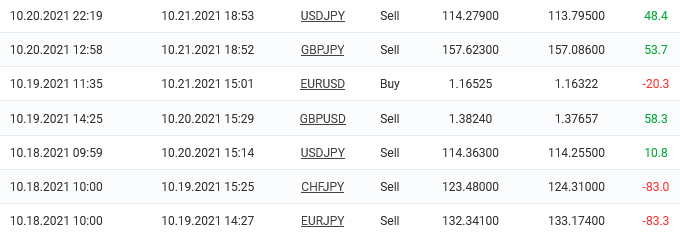

The chfjpy and eurjpy trades. Opened after MACD confirmation on the 4-hour chart. But I figured that the main daily trend should start a correction. The trend continued and trades were closed by stop loss. I took the risk of entering the market against the trend, at a time when there were no key resistance levels in the trend direction.

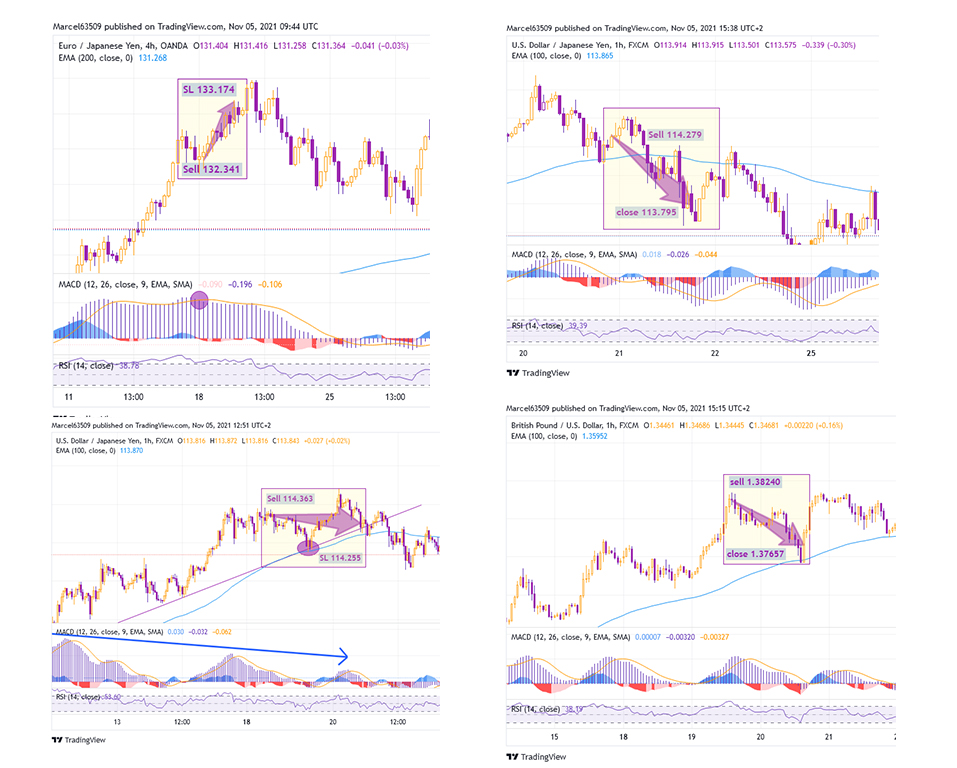

The first dollar yen trade was opened after MACD confirmation and visible divergence. During the first 24 hours, I could have taken a profit, but unfortunately, the EMA100 was not broken and the price went in the opposite direction. I should have exited at the moment the EMA100 was reached. The profit is too small.

I opened the second trade for this pair when the divergence was already more certain and the MACD confirmation became clearer. The EMA 100 was not broken, but retesting was evident. After its breakout, the trade confirmed its profitability.

The euro dollar trade. I entered the market after the key level 1.1635 was passed, but at the same time, the EMA 200 was still a strong obstacle. The stop loss level was reached after 1.16650 was tested again, and the moment the price reached it, I should have closed the trade with a profit.

The pound dollar is quite risky, but I understood that this is the resistance of the uptrend, I saw the MACD has been moving in the horizontal channel for a long time, and at the same time, the RSI has been above 70 for a long time.

And the yen trade was opened by clear confirmation from MACD. I did not close the loss during testing the 158.20 level, knowing that there might be a reversal, but at the same time, I did not risk waiting for the EMA 100 to be broken, since 157.00 was already close and could provide support.