EUR/USD trading talks April 24

Preliminary pre-trade EUR/USD analysis.

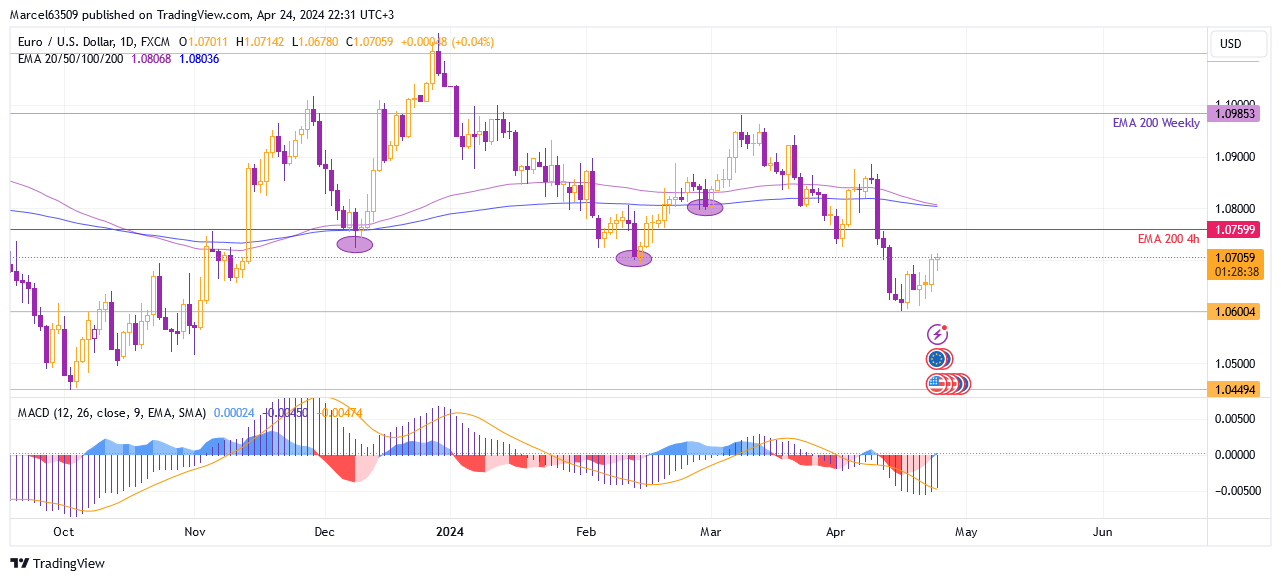

Euro/Dollar is trying to regain the level lost last week, starting a correction after falling to 1.06000. However, I see the possibility of the fall continuation and even an attempt to decline to 1.04500.

On the four-hour chart, the Euro Dollar is now trying to cross the EMA 100, which coincides with the key resistance level of 1.07000. Thus, the currency pair will face a strong obstacle to growth, which may lead to further decline. In addition to the EMA 100 level, on the four-hour chart I would highlight the EMA 200 level, which will be a marker for buying if nevertheless the market overcomes 1.07000 and has the power to grow further. But even in case of growth, the prospect of possible targets does not look attractive, because at the level of 1.08100 the currency pair will encounter additional resistance, which is also the level of the current daily EMA 100, 200. The next level will be located nearby, at 1.08800.

In my opinion, at the moment, it is more likely that the correction will end, it’s already exhausted, and will fall again to 1.06000. However, this may be the beginning of some correctional channel with several stages of fluctuations, but nevertheless, if 1.06000 is passed, then a fall to 1.04500 will be a logical continuation. If in the near future, after testing the four-hour EMA 100 at 1.07150, the price does not go higher, but begins to fall, then the MACD will confirm the prospect of a further fall deeper, moving into the negative zone.