EUR/USD trading talks January 17

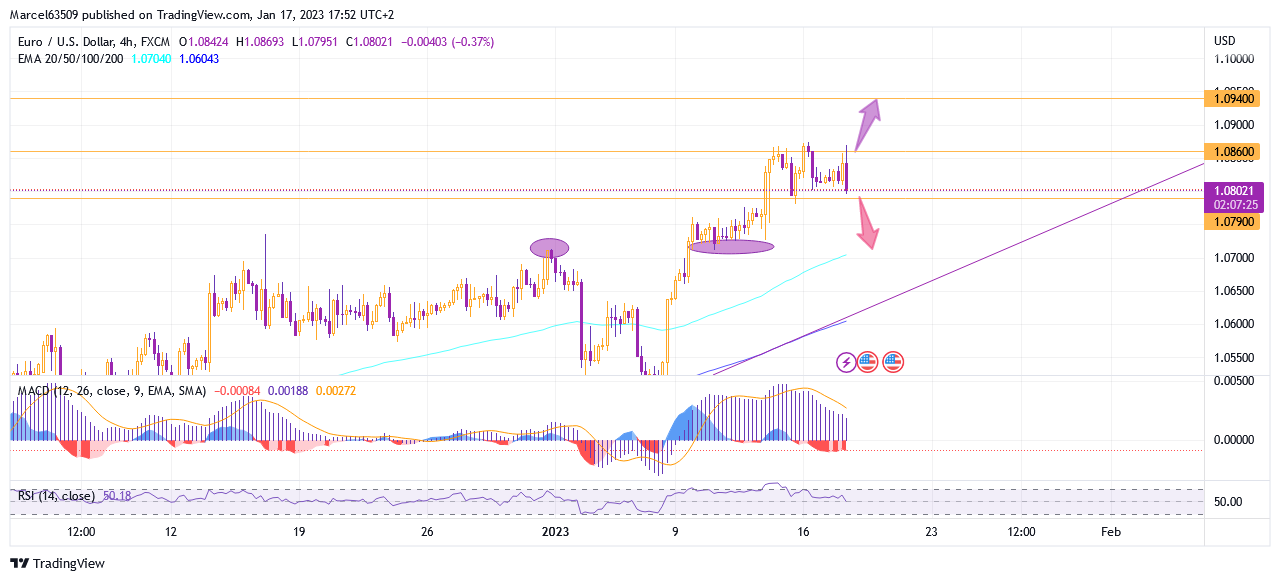

EUR/USD continues to move within the uptrend, this time forming a new correction. The currency pair is confidently but so far unsuccessfully trying to break through the key level 1.08650, which at this stage is a marker for possible further growth and trend expansion. At the same time, the EMA 100 line on the weekly chart is currently at 1.08530. The crossing of this line this week cannot yet be marked as a clear buy signal, since at this stage it is a false breakout. But in this way, I can conclude that this resistance area is putting quite a lot of pressure on the price formation.

Of course, if the weekly EMA 100 is confidently broken and at the same time 1.08650, the continued growth to the historical 1.09400 and then to the weekly EMA 200 line is highly possible.

Despite the fact that the influence of the resistance is strong enough to prevent further growth for the third time since Friday, the buy MACD signals on the daily chart are quite clear, as well as on the weekly one.

Given the pressure of the resistance levels, I have to consider a possible fall after the current correction. The key level for a sell signal is the EMA 100 line on the hourly chart, which is now at 1.08050. The marker level is a support at 1.07900 hat is also forms the boundaries of the correction channel. In case of crossing the EMA 200 line on the hourly chart, which is at the level of 1.07600, I would predict the continuation of the fall until the area of 1.07160 and EMA 100 on the four-hour chart. The MACD signal on the four-hour chart shows a steady decline.

Thus, I assume that a correction and a short-term fall is possible now, after recent impulses, but after reaching more confident support levels, growth may resume again according to the current uptrend. Regardless of the forecast, I will wait for the clearest signals and reaching the markers in order to start trading.