Profit / loss analysis of two EUR trades

EUR/USD

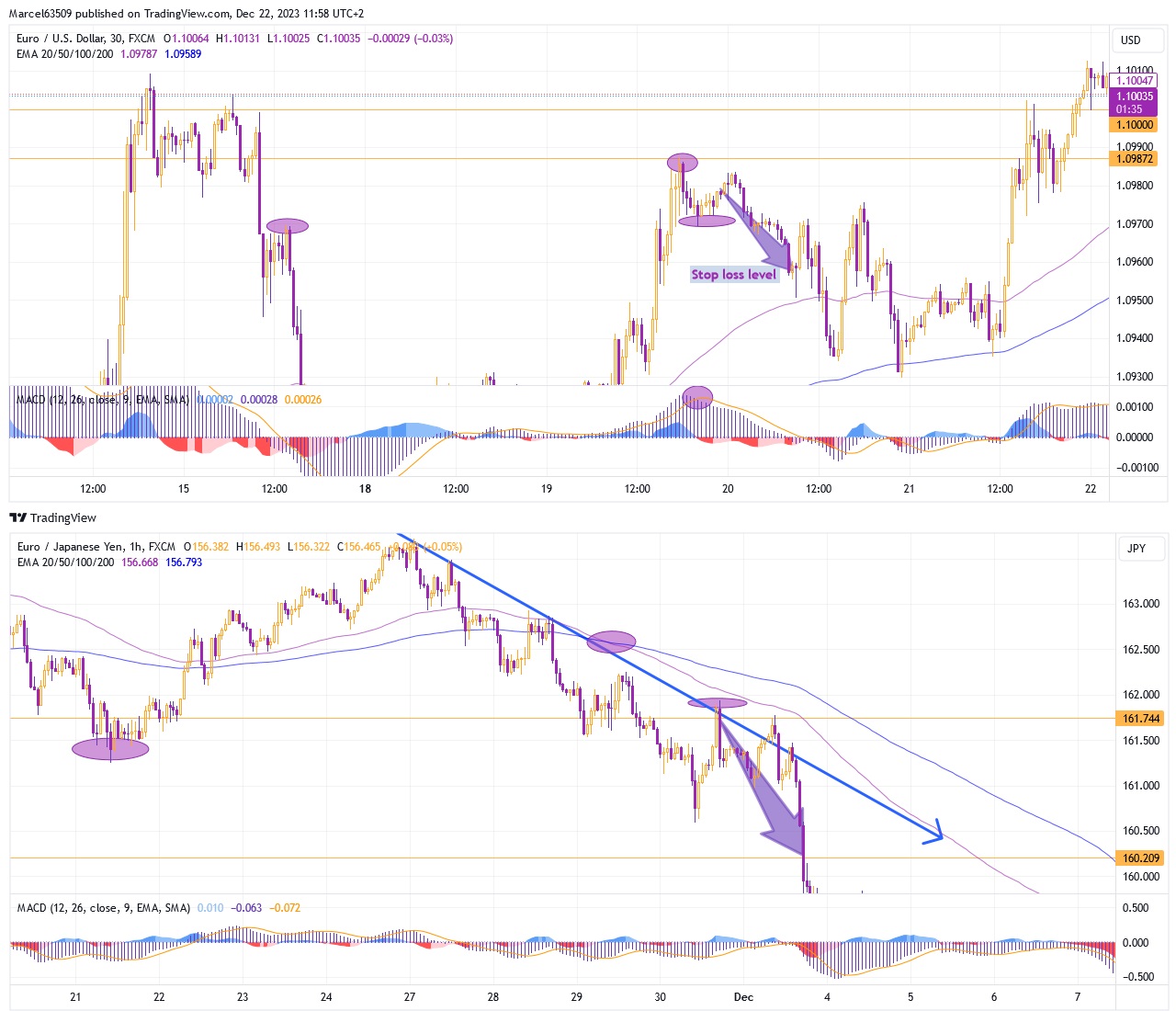

The trading analysis for today will consist of two parts (profit and loss). And I’ll start with a trade that was closed by stop loss on Wednesday EUR/USD with the drawdown of 1.26%.

My analysis and subsequent expectations were based on the fact that I saw a high probability of reaching the 1.10000 double top level in the coming hours and accordingly focused on short-term profits. It is important to note that this conclusion came true for now. When I entered the market, I understood the risk associated with the likely formation of a correction in a narrowing channel and therefore secured the trade with a stop loss. But unfortunately, I did not take into account the possibility of the 1.09870 level pressure, which turned out to be a key resistance. The opening of the trade was also justified by the fact that there was an increase after the correctional wave to the level of 1.09700. I believed that support would contribute to further growth. But I neglected the short-term MACD indicators, which could have confirmed a further decline, instead I paid attention first to the four-hour MACD and a clear buy signal. An inaccuracy that was decisive.

EUR/JPY

The second trade worth discussing is EUR/JPY, the closure of which brought a profit of 153.5 points. The opening of the trade was in accordance with the downward trend after a slight corrective growth. I saw the probability of the narrowing channel formation, but decided not to wait for the market to determine, since the opening of the correction would still be downward. The further fall confirmation was the intersection of the EMA levels 100 and 200 on the four-hour chart, as well as the fairly confident MACD transition to the negative values zone and the signal line position. The 30-minute chart shows a clear touch of the EMA 100 line, the preliminary resistance at 161.654, while the EMA 200 was the key marker level for further growth. I carefully monitored these levels and if they were broken, I would close the trade as likely unprofitable. The trade was closed after reaching the level of 160.330 and although I saw a high probability of a further fall, there was also the danger of a rollback after a rapid fall and a possible long-term correction, so the decision was made to take profit and exit the market.

Watch trades on MYFXBOOK