Trading analysis of recent GBP/JPY trades

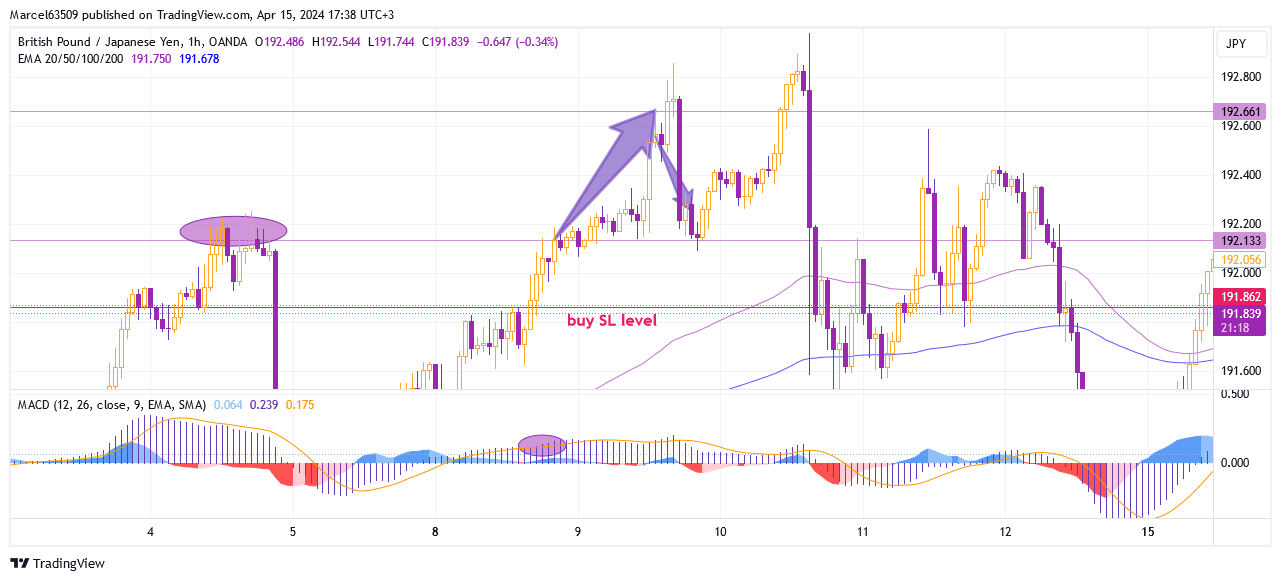

There are four successful trades were closed on GBP/JPY during the growth and following correction on April 8-9. The MACD indicated further growth, while the EMA lines became far below the price level on short-term and long-term time frames. Moreover, the key resistance at 192.130 was not strong enough to stop further breakout and growth.

I was counting on a more volatile rise to 193.500 and a sharp drop back to the level of the current price, but unfortunately, I had to trade fewer points and close buy trades earlier. After a successful long, I waited for the correction to begin and started short with the aim of falling to the key level 192.130 area. As you can see from my trading statement, these sell trades were also profitable.

As a final statement, I would like to note the dawdown during sell trades and the risk of further growth when the price reached 192.860. There are a few things I can take away from this situation:

- I will work on improving the exit from the market, because the buy profit could have been taken at the maximum level of 192.860.

- The good point is that I did not close the loss at the top, knowing that according to my data, a correction will follow.